Overview

Nikkei 225 High Dividend Stock 50 Index is a stock index comprised of 50 high dividend yield stocks selected from the Nikkei 225 constituents. The index is calculated based on the "Dividend Yield Weight Method" which determines the each weight of the index constituent by the dividend yield, additionally taking into account the liquidity (trading value).

-

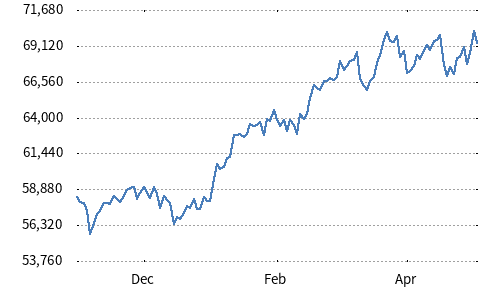

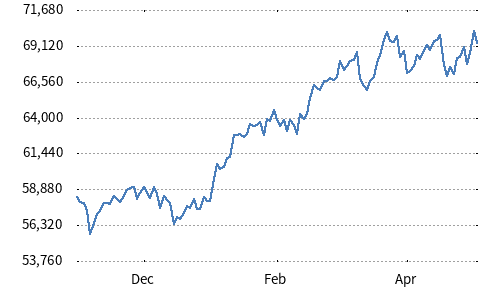

Chart

-

Constituents50 issues are selected from the constituents of the Nikkei Stock Average (Nikkei 225).

-

Periodic reviewAnnually (June)

-

Selection rules

- Using the Nikkei’s forecasts on dividends, the stocks with higher expected dividend yields at the end of May are chosen based on the selection rule of the Periodic Review.

- Although Nikkei extraordinarily removes the stocks deleted from the Nikkei 225, the new constituents will not be added for the removals and the number of the constituents will be back to 50 at the next Periodic Review.

-

Number of constituents50

-

WeightingDividend yield weight (However, the constituents' weights are adjusted by the Liquidity Factors allocated based on the daily average trading values for the past one year)

-

Calculation Method

- The index is calculated by summing up the constituent share prices multiplied by the Weight Factors, and dividing the summation by the Divisor.

- The Divisor is adjusted like the base market value for the market capitalization based index.

-

Calculation frequencyEnd-of-day basis

-

Commencement dateJanuary/10/2017

-

Inception dateDecember/28/2001

-

Calculation base dateDecember/28/2001 = 10,000

Related News

-

Sep/08/2025

-

Sep/01/2025

-

Jul/24/2025

Changes to the Index Guidebook of the Nikkei Stock Average Regarding the Treatment of Spin-Offs