Overview

The Nikkei Stock Index 300 is a market value-weighted index to represent overall Japanese market with smaller number of stocks.

-

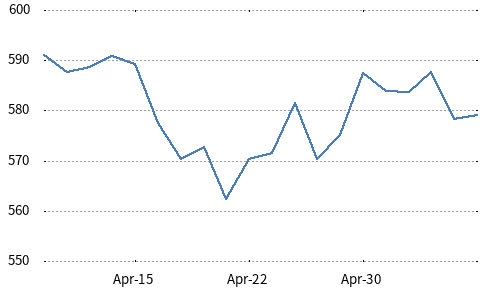

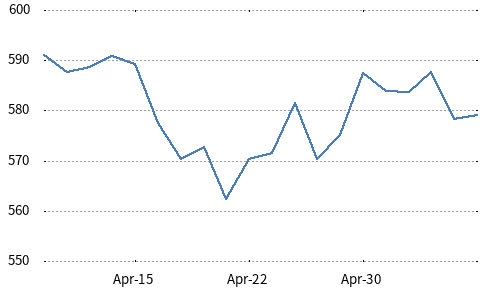

Chart

-

ConstituentsCommon stocks in the Prime Market of the Tokyo Stock Exchange

-

Periodic reviewAnnually (October)

-

Selection rules

- The Annual Review is conducted based on increase in market value for the past 3 years and its contribution for each 36 industrial sectors.

- In case of delisting of the index constituents due to a merger or bankruptcy, stocks are added by the Extraordinary Replacement, and the number of components remains at 300.

-

Number of constituents300

-

WeightingMarket value weight

-

Calculation Method

- The index is calculated by dividing the current total market value by “base market value”.

-

Calculation frequencyReal time (every 5 seconds)

-

Commencement dateOctober/08/1993

-

Inception dateOctober/01/1982

-

Calculation base dateOctober/01/1982 = 100

Related News

-

Sep/16/2025

-

Jul/24/2025

Changes to the Index Guidebook of the Nikkei Stock Average Regarding the Treatment of Spin-Offs

-

Jun/20/2025