Overview

The Nikkei 225 USD Hedged Index is one of the indexes which consists of the “Nikkei 225 Currency Hedged Indexes” and the index measures the return of the Nikkei 225 archieved by fully hedging its currency risk for investors outside Japan i.e. non-Yen, USD-based investors. This index represents the mixed positions of the Nikkei 225 investment in other currencies than JPY, and the relevant currency hedged transactions. The Nikkei 225 Total Return USD Hedged Index which is based on the Nikkei 225 Total Return Index is also calculated and published. Both indexes are calculated by using a monthly hedging method.

-

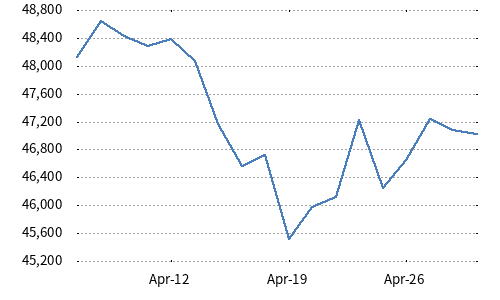

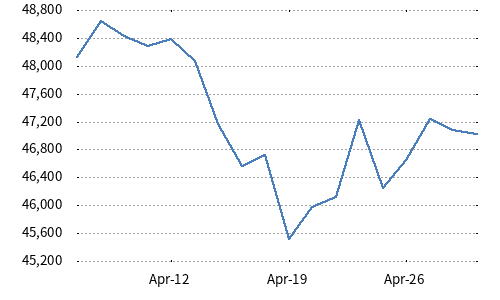

Chart

-

Underlying indexNikkei 225

-

Calculation Method

- Index value on a day is calculated by multiplying the index value on the end of the previous month by (1) the return of the Nikkei 225 from the end of the previous month, (2) the return of the spot currency rate from the end of the previous month, and (3) the currency hedge return from the end of previous month, respectively.

- This index apply a hedge ratio is 100%.

-

Calculation frequencyEnd-of-day basis

-

Commencement dateDecember/08/2014

-

Inception dateSeptember/30/2004

-

Calculation base dateSeptember/30/2004 = 10,823.57