Overview

The JPX-Nikkei 400 Net Total Return EUR Hedged Index is one of the indices which consists of the "JPX-Nikkei 400 Currency Hedged Index" and the index measures the return of the JPX-Nikkei 400 Net Total Return Index achieved by fully hedging its currency risk for investors outside Japan i.e. non-Yen, EUR-based investors. In addition to the JPX-Nikkei 400 Net Total Return EUR Hedged Index calculated by using a monthly hedging method, the JPX-Nikkei 400 Net Total Return Daily EUR Hedged Index is also calculated by using a daily hedging method.

-

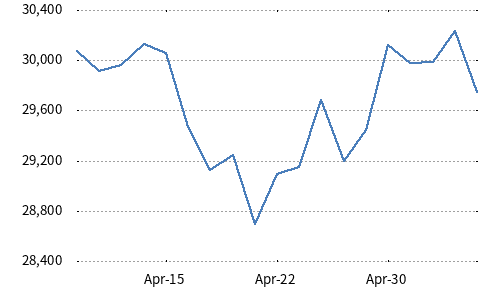

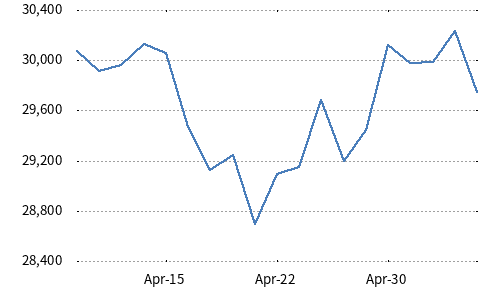

Chart

-

Underlying indexJPX-Nikkei 400 Net Total Return Index

-

Calculation Method

- Daily return of the index is calculated by the combination of the following 2 returns: (1) The return of the Target Index i.e. JPX-Nikkei 400 Net Total Return Index in foreign currency, which is the return accruing from an unhedged Target index investment to an investor whose home currency is not JPY, (2) The return from the hedge, calculated by a linear interpolation of spot and forward prices.

- This index apply a hedge ratio is 100%.

- Both monthly hedged index and daily hedged index are calculated.

-

Calculation frequencyEnd-of-day basis

-

Commencement dateJanuary/26/2015

-

Inception dateDecember/30/2008

-

Calculation base dateAugust/30/2013 = 10,000

Related News

-

Sep/10/2025

Change to the JPX-Nikkei Index 400 and the JPX-Nikkei Index Human Capital 100

-

Sep/03/2025

-

Aug/07/2025

Periodic Review of "JPX-Nikkei Index 400" and "JPX-Nikkei Mid and Small Cap Index"