Overview

Nikkei 225 Domestic Exposure 50 Index is the equal-weighted stock index designed for focusing on trend of Japanese equities with high domestic exposure. The constituents are chosen from the Nikkei 225 constituents using a gauge "Oversea Sales Ratio" (the ratio of oversea sales from outside Japan to the gross sales of each company).

-

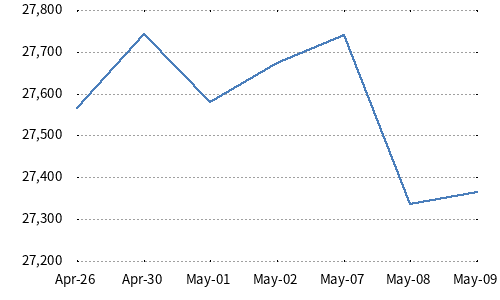

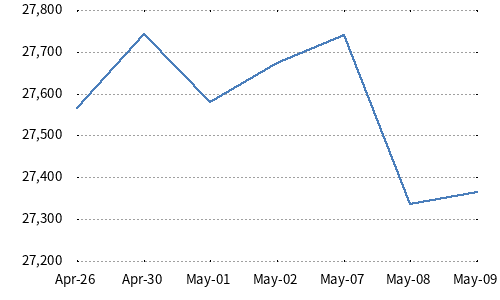

Chart

-

Constituents50 issues are selected from the constituents of the Nikkei Stock Average (Nikkei 225).

-

Periodic reviewAnnually (October)

-

Selection rules

- Using the "Oversea Sales Ratio" reported by Securities Reports of the companies whose accounting fiscal year has ended till March in each year, the stocks with lower "Oversea Sales Ratio" will be added and the stocks with higher "Oversea Sales Ratio" will be deleted.

- In case that companies have the same "Overseas Sales Ratio", the company with higher liquidity (average daily trading values for a one year) will become an added stock preferentially.

- Although Nikkei extraordinarily removes the stocks deleted from the Nikkei 225, the new constituents will not be added for the removals and the number of the constituents will be back to 50 at the next Periodic Review.

-

Number of constituents50

-

WeightingEqual weight (However, the constituents' weights with low liquidity (lowest 20% in Nikkei 225) shall be halved)

-

Calculation Method

- The index is calculated by summing up the constituent share prices multiplied by the Weight Factors, and dividing the summation by the Divisor.

- The Divisor is adjusted like the base market value for the market capitalization based index.

-

Calculation frequencyEnd-of-day basis

-

Commencement dateApril/15/2019

-

Inception dateDecember/28/2001

-

Calculation base dateDecember/28/2001 = 10,000