Overview

The Nikkei 225 Total Return Index measures the performance of the Nikkei 225 that includes both movements in the index level and reinvestment of dividend incomes from its component stocks.

-

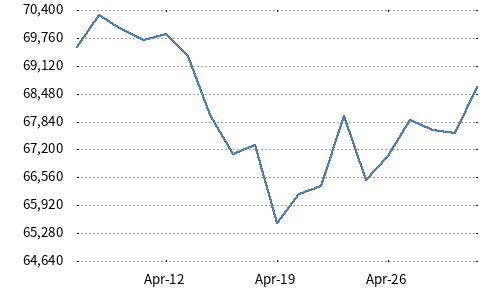

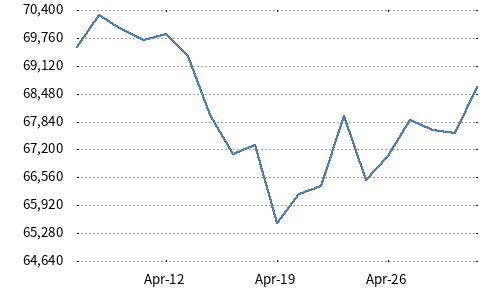

Chart

-

Underlying indexNikkei 225

-

Calculation Method

- Index value on a day is calculated by multiplying the index value on the previous day by the daily return of the value including the dividend.

- Estimated dividends are used for the index calculation on the ex-date. The difference between the estimated dividend and the actual dividend reflects the index on the next business day when the dividend is fixed.

-

Calculation frequencyEnd-of-day basis

-

Commencement dateDecember/03/2012

-

Inception dateDecember/28/1979

-

Calculation base dateDecember/28/1979 = 6569.47