Overview

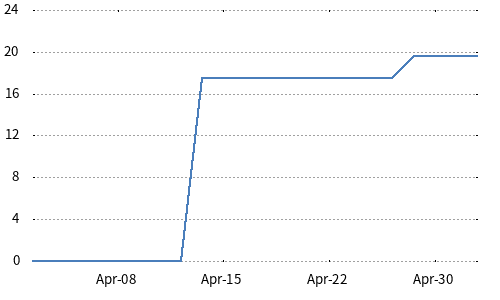

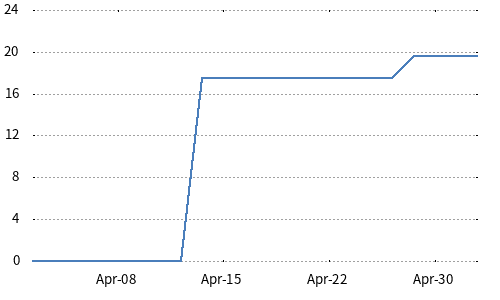

The Nikkei Stock Average Dividend Point Index is an index that accumulates dividends received from the companies when investors are supposed to hold the constituents of the Nikkei Stock Average (Nikkei 225) on a calendar year basis, i.e. January to December in a year. The index is calculated by substituting each actual dividend per share into the formula of the Nikkei 225 every time the each dividend value is fixed. Its final index value of the year is published at the beginning of April in the subsequent year after the all dividend payments of the constituents are fixed. The index is expressed with a year such as the Nikkei Stock Average Dividend Point Index (2011) since the index is calculated by accumulating the dividends every calendar year basis. The index value of the previous year is displayed until 1st business day of April, and the index of the current year is displayed from the 2nd business date of April on this page.

-

Chart

-

ConstituentsNikkei 225 constituents (Gross cash dividends whose ex-dividend dates are between January 1 and December 31, including special dividends and commemorative dividends)

-

Number of constituents225

-

Calculation Method

- The index is calculated by substituting the received dividends of the constituents into the formula of the Nikkei 225.

- After adjusting each dividend by the price adjustment factor, the adjusted value shall be divided by the divisor on its ex-dividend date and accumulated.

-

Calculation frequencyEnd-of-day basis

-

Commencement dateApril/09/2010

-

Inception dateJanuary/06/1998

-

OthersThe dividends paid corresponding to the annual accounting period shall be included in the index value on the next dates of the annual regular shareholder meetings and the dividends paid on the other dates shall be included on the next dates of the publication by the companies.

Related News

-

Jun/09/2025

Index Consultation Regarding the Treatment of Spin-Offs in the Nikkei Stock Average

-

Apr/01/2025

Nikkei Dividend Index reaches its historical high at 692.00 in 2024

-

Oct/04/2024