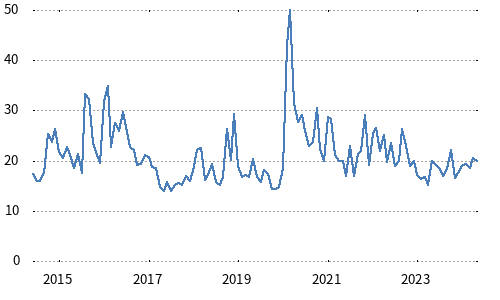

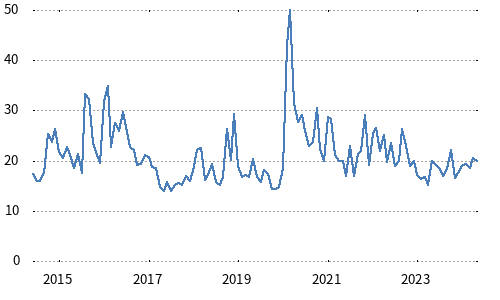

Overview

The Nikkei Stock Average Volatility Index (Nikkei 225 VI) indicates the expected degree of fluctuation of the Nikkei stock Average (Nikkei 225) in the future. The greater the index values are, the larger fluctuation investors expect in the market.

-

Chart

-

ConstituentsNikkei 225 Options

-

Underlying indexNikkei 225

-

Calculation Method

- The Nikkei Stock Average Volatility Index are calculated by using prices of Nikkei 225 futures and Nikkei 225 options on the Osaka Exchange (OSE).

- In the calculation, taking near-term future price as the basis of ATM, the volatility of near-term option and next-term option are calculated with OTM option prices of each delivery month.

- The index value is calculated by linear interpolation or linear extrapolation between the volatilities of each delivery month to make the time to expiration as 30 days.

-

Calculation frequencyReal time (every 5 seconds)

-

Commencement dateNovember/19/2010

-

Inception dateJune/12/1989

Related News

-

Oct/03/2025

-

Jan/20/2025

-

Jan/20/2025

Nikkei Stock Average Volatility Index Guidebook (to be effective from January 27, 2025)