Overview

The Nikkei 225 VI Futures Index is designed to reflect the daily price fluctuation of a position that combines the near-term and the next-term Nikkei Stock Average Volatility Index Future (Nikkei 225 VI Future) prices at specified weights. The weights are adjusted daily to keep the maturity of the combined future contracts constant as the term exact one month.

-

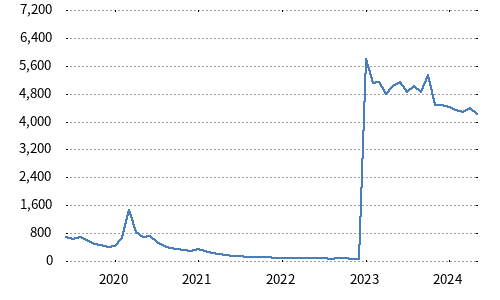

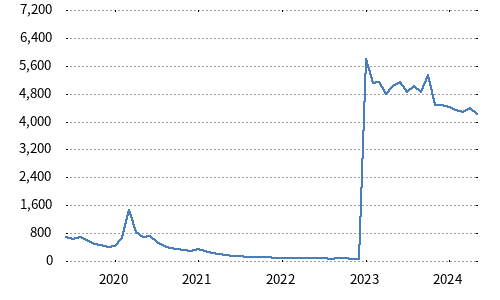

Chart

-

ConstituentsNikkei 225 VI Futures

-

Calculation Method

- The Nikkei 225 VI Futures Index is calculated using prices of the near-term (first -term) and next-term (second-term) contracts of the Nikkei 225 VI Futures.

- The combined future contract with exact one month maturity is composed by changing the weights for the two future contracts on a daily basis.

-

Calculation frequencyEnd-of-day basis

-

Commencement dateDecember/03/2012

-

Inception dateFebruary/27/2012

-

Calculation base dateFebruary/27/2012 = 10,823.57 (The index value has been adjusted to raise its level by two digits since January 23, 2023)