Overview

The Nikkei High Yield Index is a REIT index comprised of high yield REITs calculated by "Market Cap multiplied by Yield Weight" Methodology.

-

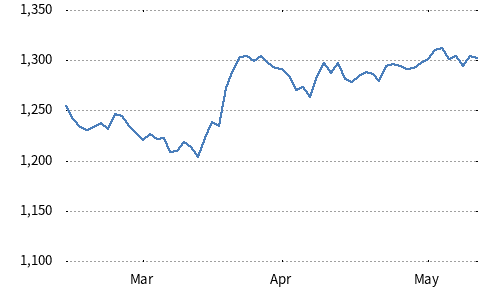

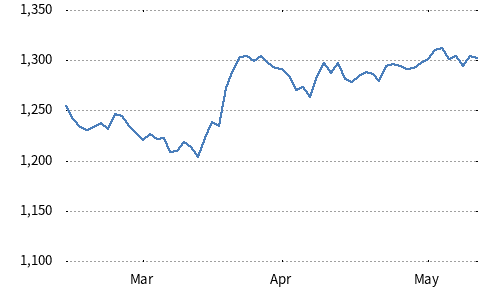

Chart

-

ConstituentsAll REITs listed on the Tokyo Stock Exchange

-

Periodic reviewAnnually (May)

-

Selection rules

- Using the Nikkei’s forecasts on dividends, the stocks with higher expected yields at the end of April are chosen based on the selection rule of the Periodic Review.

-

Number of constituents35

-

WeightingMarket Cap multiplied by Yield Weight

-

Calculation Method

- The index is calculated by summing up the constituent share prices multiplied by the Weight Factors, and dividing the summation by the Divisor.

- The Weight Factor is determined by the number of issued shares and ESG factor.

- The number of shares issued shall be revised in February, May, August and November, and the ESG factor shall be revised in November.

-

Calculation frequencyEnd-of-day basis

-

Commencement dateJuly/20/2020

-

Inception dateMay/30/2014

-

Calculation base dateMay/30/2014 = 1,000