Overview

The Nikkei 225 Covered Call Index is designed to indicate the performance of "Covered Call strategy" on the Nikkei Stock Average (Nikkei 225). The index is one of the indexes which consists of the "Nikkei Stock Average Strategy Index Series" and is an index that would satisfy investors' needs to make their performances better in case that the stock market fluctuates in narrowed range.

-

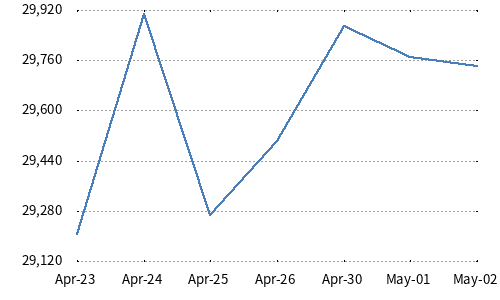

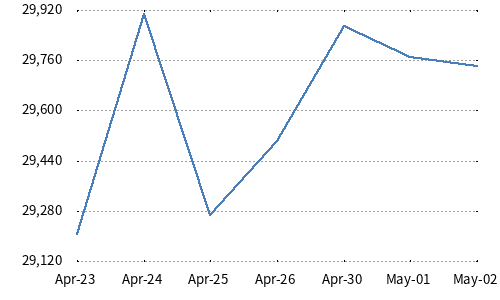

Chart

-

Underlying indexNikkei 225

-

Calculation Method

- Index value on a day is calculated by multiplying the index value on the previous day by the daily return of the value which subtract the target option price from the Nikkei Stock Average.

- The target option will be "rolled" every month to the newly near-term call option with the strike price of 5% higher than the Nikkei 225 on the day before SQ date.

-

Calculation frequencyEnd-of-day basis

-

Commencement dateJune/06/2011

-

Inception dateDecember/28/2001

-

Calculation base dateDecember/28/2001 = 10,000

Related News

-

Oct/04/2024

-

Oct/18/2023

-

Nov/21/2022

Change to the Index Guidebook of Nikkei Covered Call indexes