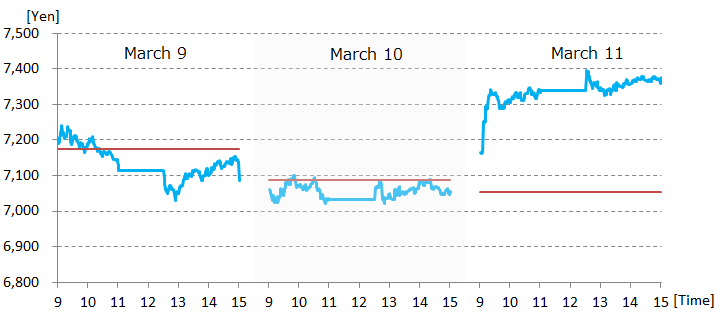

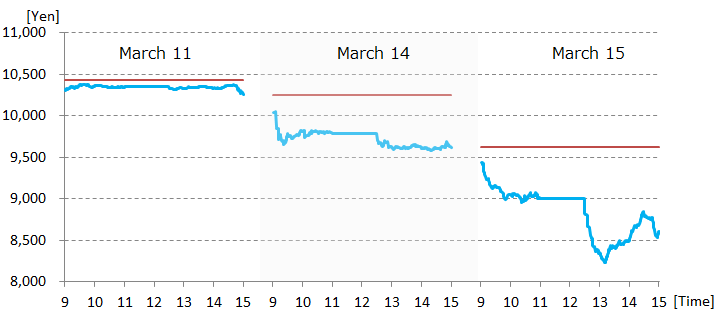

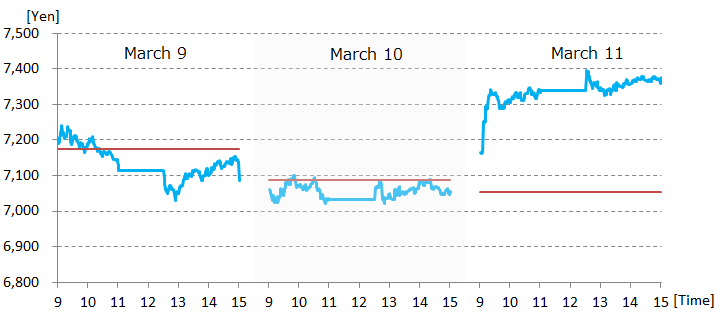

On Tuesday, March 10, 2009, the Nikkei Stock Average fell for the third consecutive day, closing at 7,054.98 yen, 31.05 yen (0.4%) lower than the previous day. This small decline went down in the history of the stock market as the record closing low of the post-bubble era. The Nikkei 225 fell to 7,607 yen in April 2003 after the bursting of the bubble economy in the 1990s and returned to 18,261 yen in July 2007. But on October 27, 2008, the average fell to its lowest point since the bursting of the bubble (7,162.90 yen, closing basis) due to the economic downturn triggered by the Lehman shock in September. On October 28, the average briefly fell temporarily below 7,000 yen to a low of 6,994.90 yen during the trading hour. After this downturn, the Nikkei 225 remained listless as it stayed in a trading range centered at 8,000 yen.

On Monday, March 9, 2009, the Nikkei 225 was down again as investors sold stocks because rising U.S. unemployment sparked worries about a global economic downturn and falling corporate earnings. Selling targeted megabanks and other financial stocks, stocks of automakers and other export-dependent companies, and many other sectors. Prices fell again on Tuesday, this time dragging the Nikkei 225 down to the lowest level since October 6, 1982. The Japanese government responded with statements including the determination to prevent low stock prices from triggering a credit crunch, which was announced by Kaoru Yosano, who was the Minister for Economic and Fiscal Policy. Investors started buying stocks due to expectations for economic stimulus measures and the use of public pension funds to buy stocks. These moves enabled the Nikkei 225 to stay about 7,000 yen.

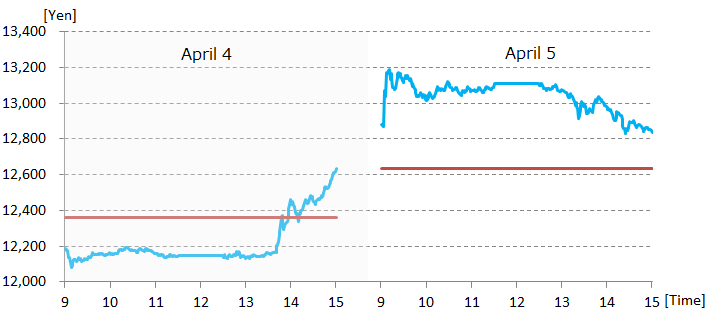

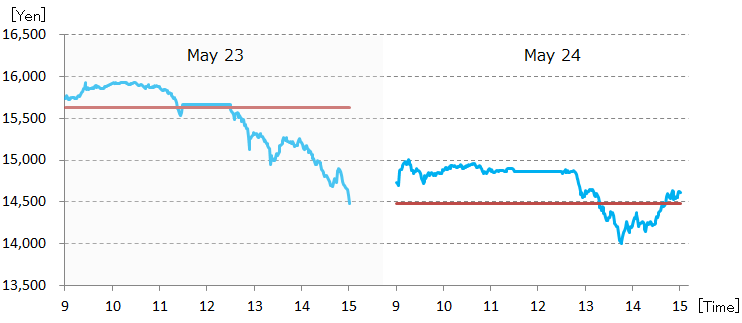

On Wednesday, March 11, the Nikkei 225 rebounded sharply for the first time in four days due to a powerful rally in New York the previous day. Financial stocks and export-related stocks, which had been sold off, were bought back. This rebound was the beginning of an upturn that propelled the Nikkei 225 back to the 10,000 yen level (on a closing basis) on June 12. As countries worldwide began enacting measures to support the economy, investors became increasingly confident that the global economy would quickly recover from its deep downturn. This investor optimism fueled a rally that raised the Nikkei 225 40% above its post-bubble low over a period of only slightly more than three months.